Does Tesco buying Booker make sense?

Mergers and takeovers are part and parcel of the investing world. However, I think it's fair to say that last week's (27th January 2017) announcement that supermarket giant Tesco (LSE:TSCO) was buying cash and carry operator Booker (LSE:BOK) was something of a surprise.

Takeovers or acquisitions as they are commonly known are a very grey area for investors. Are they a good thing? One thing's for sure is that investment bankers love them as they come with the promise of a hefty fees for those that are involved with the deal.

But for the shareholders of the acquiring company and those of the acquired things are rarely clear cut. This is because more often than not acquisitions turn out to be very bad for the acquiring company's shareholders' wealth as a result of the company overpaying for the target.

For the shareholders having their shares acquired a takeover is often very good news. This is due to them usually receiving a big premium over the last closing share price before the deal was announced.

However, this is only true if the takeover is an all cash bid. If shareholders are receiving shares in the acquiring company then their long-term fortunes are tied to the fortunes of this company. They might have been better off rejecting the deal and staying invested in the target company.

Unfortunately, private investors usually have no influence on whether to accept or reject a takeover bid. That will be decided by the big asset managers and pension fund shareholders. So, if the takeover involves shares, private investors have to decide whether to take a stake in the acquiring company or to sell their shares before the bid is completed.

In this article, I am going to take a closer look at Tesco's proposed purchase of Booker and what it might mean for each set of shareholders. I'll show you some of the things you can do try and work this out for yourself.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

The bottom line: Do the numbers stack up?

Company management will go to great lengths to explain why the deal will do great things for their business. Tesco is no exception in this regard. It has said that the combination of Tesco and Booker will create a great food business that will be good for customers and shareholders.

What is important to you as an investor is whether the deal will make you better off in the long run. By this, I mean will it increase the value of the business that you own a slice of? Let's first try and answer this question from Tesco shareholders' point of view.

Tesco shareholders

Weighing up a takeover as an investor in the buying company is very straightforward. You ask exactly the same questions and do very similar analysis as if you were buying a share of the target company yourself. In other words, you already own shares in Tesco and are thinking of buying some shares in Booker.

As always, you are trying to answer two fundamental questions:

- Is it a good business?

- Can I buy it for a good price - less than it is worth?

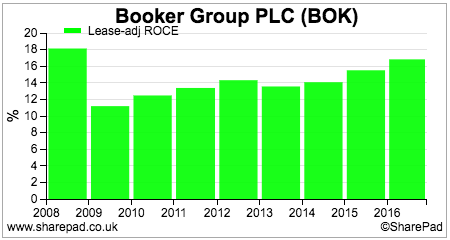

You can read my previous analysis of Booker in February 2016 here. I think it's a fairly decent business. It has been producing reasonable returns on capital employed (ROCE) for a few years as shown below.

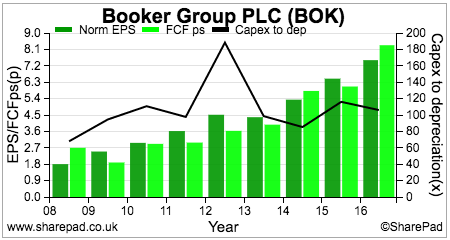

It also has good quality profits as it turns most of them into free cash flow.

On top of this, Booker has no debts, a healthy pile of cash on its balance sheet and a small and manageable pension fund deficit. Current trading is also very strong with non-tobacco like-for-like sales growing by 5.1% during the 16 weeks to 30th December 2016.

My chief concerns are that tobacco sales are still a major chunk of its sales (around 30%) and that the company's growth might have been too reliant on buying companies in recent years.

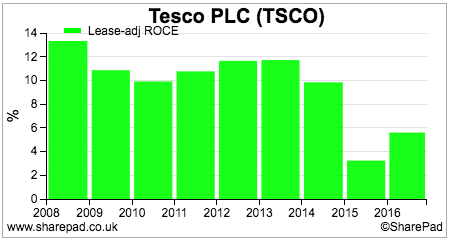

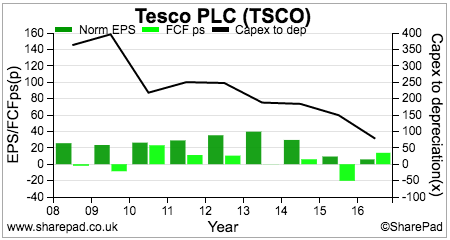

That said, Booker is almost the polar opposite to Tesco in terms of quality hallmarks. In stark contrast to Booker, Tesco's ROCE and free cash flow performance has been very poor in recent years. It also has lots of debt and a big pension fund deficit.

So from a Tesco shareholders' point of view it seems that Booker will improve the underlying quality of the business.

But is Tesco paying too much for Booker?

In my opinion, the best way to weigh up an acquisition is to look at the return on investment (or ROCE) of the deal. To this you need the following bits of information which you can quickly and easily find in SharePad:

- The price Tesco is offering.

- Booker's current or expected profits.

- The value of outstanding debt, cash balances and pension fund deficit.

This will allow you to compare the profits being bought with the enterprise value (the value of equity, net cash/debt and pension liability) being paid.

Tesco is offering 42.6p in cash and 0.861 Tesco shares for each Booker share.

Based on the closing price of Tesco shares of 189p on 26th January 2017 (the day before the deal announced) and the 1777 million Booker shares in issue this equates to 205.3p per share and an enterprise value of £3.6bn shown in the table below.

Tesco starting return on Investment from buying Booker

| £m | |

|---|---|

| Booker 2017F Profit (A) | 171 |

| Mkt Cap paid | 3648 |

| Net cash | -105.7 |

| Pension deficit | 58.5 |

| EV paid (B) | 3600.8 |

| Return on investment = A/B | 4.75% |

| Share Price paid | 205.3 |

| 2017F EPS (p) | 8 |

| PE | 25.7 |

As a rough rule of thumb, you want to see an acquisition giving a return on investment of at least 10%. (Note: Returns from acquisitions will usually be lower than the ROCE of the company being bought as a premium is usually paid to takeover the company. This lowers the return on investment for the buyer).

Here we can see that with Booker's forecast trading profits to March 2017 of £171m, Tesco's starting return on investment is a very poor 4.75%. Looking at this another way, based on on forecast EPS of 8p, Tesco is paying 25.7 times forecast EPS for Booker. Most people would see this as a high price to pay.

However, Tesco reckons that it can eke out another £200m of extra profits over the next few years. It aims to bring in £25m from selling more stuff and £175m from cutting its buying costs with suppliers, and making efficiencies with distribution and other overheads.

When these extra profits are taken into account then the deal looks better for Tesco shareholders. With Booker profits expected to be just over £200m in 2019, the return on investment is more than 11% when the extra profits are added.

| £m | |

|---|---|

| BOK 2019F Profit | 201.5 |

| Value of synergies | 200 |

| Potential 2019 Profit (A) | 401.5 |

| EV Paid (C) | 3600.8 |

| ROCE = A/C | 11.15% |

Tesco looks like it is still paying quite a high price for Booker but it will enhance its profit margins and ROCE compared with its existing business. That said, Booker is relatively small compared to the size of Tesco. It is adding just over £5bn of sales and up to £400m of profits to a business with £61bn of revenue and £2bn of profits. I estimate that its margins will increase by an extra 0.3%.

| 2019 Forecasts | Tesco | Booker | Combined |

|---|---|---|---|

| Sales (£bn) | 61 | 5.27 | 66.27 |

| EBIT (£m) | 2062 | 401 | 2463 |

| Profit margin | 3.40% | 7.60% | 3.71% |

Booker shareholders

Long-term Booker shareholders have done well as the company's trading performance has improved significantly. The share price had not made much progress in the year before Tesco's bid.

Booker shares have been highly valued by the market for some time now. On the day before the bid was announced they closed at 183p which put them on a punchy March 2017 forecast PE of 22.9 times. Given this backdrop, it is not really surprising that Tesco's bid of 205.3p is only a premium of 8.6% compared to perhaps the 20-30% premiums that are seen in many takeovers.

If you are a Booker shareholder you need to ask yourself if this is enough. City analysts are forecasting EPS to increase from 8p in 2017 to 9.4p in 2019. Would shareholders be better off without Tesco as they would also forego dividends as well?

That said, with Booker shares on such a high valuation there is little room for trading disappointments. A slowdown in trading and cuts to analysts' forecasts could see Booker shares experience heavy falls which would make Tesco's current offer look very generous.

However, Booker shareholders are only being offered 42.6p of cash for their shares. The true value of the deal is based on what will happen to the price of Tesco shares in the future. Based on the 42.6p of cash and 0.861 Tesco share offer this is what the value to Booker shareholders looks like at different Tesco share prices.

| Tesco share price(p) | Implied BOK price (p) |

|---|---|

| 175 | 193.3 |

| 180 | 197.6 |

| 185 | 201.9 |

| 189 | 205.3 |

| 190 | 206.2 |

| 195 | 210.5 |

| 200 | 214.8 |

| 205 | 219.1 |

| 210 | 223.4 |

| 220 | 232 |

If you think that Tesco shares are good value at current prices (a 2018 forecast PE of 21 at 195p) and its shares will go higher then you might be tempted by the deal. If not, you might consider selling your shares in the market.

The key driver of the Tesco share price in the future is unlikely to be based on the fortunes of Booker but whether it can rejuvenate its struggling UK supermarkets in the face of fierce competition. It seems fair to say that Tesco still has lots to prove in this area.

Will the deal go through?

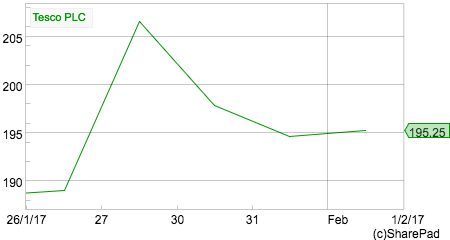

Tesco's share price responded well initially to the announcement of the deal but has since fallen back a little. This may be due to concerns about the strategic rationale of the deal and whether it is paying too much.

There are also concerns that the deal might be blocked by the competition authorities. Tesco has a 28% share of the UK grocery market which consists of lots of convenience stores, whilst Booker owns convenience store chains Premier, Budgens & Londis. Whilst these are franchises, it would give Tesco extra grocery market share in the UK.

Booker also supplies other independent retailers and caterers and it is by no means certain that they would be happy to be supplied by a business owned by Tesco.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.