How to understand profit warnings

Share prices are based on expectations of a company's future profits. These expectations are reflected in professional analysts' forecasts for measures such as pre-tax profit or earnings per share (EPS).

When a company realises that its profits will fall short of analysts' or its own previously stated forecasts it has to inform the stock exchange as soon as possible. This is known as a profit warning.

According to a study by Ernst & Young the number of UK profit warnings during 2015 was the highest since before the financial crisis in 2008. Last year 313 companies issued profits warnings with 100 companies issuing them during the last three months of the year.

Profit warnings represent one of the major risks involved in owning a share. If you own shares in a company which issues a profit warning then don't be surprised to see the value of your shareholding plummet.

But what do you do when a company issues a profit warning? The answer depends entirely on the circumstances behind it. Some can mean a permanent loss in value whilst others can provide an opportunity to make money.

In this article, I am going to look at the subject of profit warnings a little more closely and show you how you might react to different types of warning. I'll also show you some things to look out for which might help you spot companies with a higher risk of a profit warning.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Restaurant Group - A case study in profit warnings

The share price of Restaurant Group (LSE:RTN) has fallen by nearly 60% since the start of 2016. The company is a very typical and interesting example of how profit warnings can develop and how the damage inflicted on a share price can very severe.

On 14 January 2016, the company released a trading update to investors about the end of its 2015 financial year. The year had gone well with a healthy increase in sales and profits. The outlook for 2016 was much more downbeat:

"It has become apparent from much of the recent data from the retail sector and the wider economy that the trading environment for many consumer facing businesses has been tougher in recent months than it was earlier in 2015. This has caused like-for-like sales growth to trend lower and accordingly we are more cautious than previously on the outlook for 2016. A possible referendum on the UK's continued membership of the European Union, National Living Wage implementation and global uncertainty are all additional issues that we are conscious of going into the new year."

This was not a very helpful statement but the use of certain words (highlighted in black by me) would have left no analyst in any doubt what the company was implying. This is an example of something that is known as a veiled profit warning. It's when companies hint that profits will be lower than most analysts are forecasting but they don't then give any indication of how much lower they actually might be. Analysts and professional investors tend to be very unforgiving in these circumstances and figure that they need to take a knife to their forecasts .The share price fell by over 18% from 638p to 522p

When you come across a statement like this early in a company's financial year you should probably brace yourself for worse to come. This is because once trading has started to turn down and the company cannot (or will not) quantify the likely hit to profits it usually means it will get worse before it gets better. Selling your shares at this point will often protect you from further pain in the future.

On 9th March the company updated investors again:

"After 10 weeks trading in 2016 total sales are up by 6% and like-for-like sales are down by 1.5%. The more challenging trading conditions we saw at the end of last year have continued into the early part of 2016, reflecting a softening in consumer demand and weaker overall consumer confidence. Whilst still early in the year, our assessment is that this more challenging environment and recent trading patterns are likely to persist. Although total sales will continue to increase as our new restaurants open and deliver good returns, in the current environment consistent like-for-like sales increases are likely to be difficult to generate.

However, notwithstanding this backdrop, we are confident that the underlying strengths of our business and brands, combined with the mitigating actions we are taking, will ensure that TRG continues to making profitable progress in 2016 and the years ahead."

This time the company gave a bit more information on the trend in sales. It said that like-for-like sales for 2016 were unlikely to grow but that it still expected profits to be higher than in 2015 (citing "profitable progress" in 2016). The company's normalised earnings per share (EPS) was 33.5p in 2015, so EPS was on track to be higher than this. On the day, the shares fell by 22.6% from 543p to 420p.

On 29th April the company said that trading had deteriorated further:

"The Restaurant Group today provides an update on recent trading and its expectations for the 2016 financial year.

Since we updated on current trading with the preliminary results on 9(th) March, we have seen a further deterioration in trading conditions, with our Leisure business, in particular, continuing to be impacted by the structural and business challenges referred to in the March Preliminary results statement. As a result for the 17 weeks to 24 April, total sales are up 4.7% and like for like sales are down 2.7%.

In the short term, we do not anticipate any improvement to underlying like for like trends and, on this basis, we now expect full year like for like sales to be down between 2.5% and 5.0% which would translate into full year profit before tax in the range of GBP74m to GBP80m."

This is a full blown profit warning where the company actually gives investors a profit forecast for the 2016 year. The share price fell by 36% on the day from 374p to 275p. Since 14th January the share price had fallen by 57% and ultimately led to the company's finance director losing his job.

You can also work out for yourself how quickly sales have deteriorated with a clever little bit of maths. You can do this for any company that regularly discloses LFL sales information. We know that like-for-like sales (LFL) were down by 1.5% after 10 weeks.

Multiply -1.5 by 10 to get -15

After 17 weeks LFL sales were down by 2.7%.

Multiply -2.7 by 17 to get -45.9

To work out the LFL sales trend in the last 7 weeks:

Take away the 10 week figure of -15 from the 17 weeks figure of -45.9 to get a figure of -30.9 and divide by 7 which gives a LFL sales decline of 4.4% for the last 7 weeks.

The company says that it expects LFL sales to be down by between 2.5% and 5% for the whole year. They are currently declining at a rate of 4.4%. Could it be actually worse than 5%? LFL sales would have to fall by 6.1% for the rest of the year as explained below.

-5 x 52 = -260

-2.7 x 17 = -45.9

For the remaining 35 weeks LFL sales would have to fall by 6.1% (214.1/35)

It is possible that LFL sales trend could continue to deteriorate as the current falls have happened very quickly but the company still could have a little bit of a buffer.

So why has the damage to Restaurant Group's share price been so severe? Let's look at some of the lesson for investors here.

The shares were highly valued before the profits warning

Shares with high valuations (such as a high PE ratio) can be explained because the expectations for rapid future profits growth are high. When those expectations are dashed and the expectations for future growth are revised down the shares can and often do fall a long way.

On 14th January at 638p the shares traded on a price earnings ratio of 19 times based on 2015 EPS of 33.5p. Now consensus analyst forecasts for 2016 EPS are 28.4p. With a share price of 280p the PE has fallen to 9.9 times highlighting that the expectations for future profits growth are now very low. Shareholders get hit by a double whammy of lower profits and a lower PE ratio. The experience of Restaurant Group is a clear example of the risks to investors of owning expensively valued shares - there's no room for disappointment.

Retail businesses are very susceptible to slowing growth

I have to admit that I am quite wary of retail companies - certainly those that sell through stores on the high street or on retail parks. Let me explain why.

Growth tends to be based on opening more new stores. These new stores then go through a process of maturing over a few years to get up to an optimal level of sales and profits. This gives the impression of strong underlying - or like for like (LFL) - growth when really it's just a maturation process. When the stores mature they struggle to keep on growing.

The other potential problem is that retail companies open too many stores. A new store might open close to an existing one and take some custom away from it. This process is known as cannibalisation of sales and is a big risk.

I suspect that these issues have been a big factor in the deteriorating trading performance of Restaurant Group.

You can spot potential problems by keeping an eye on the trend in measures such as LFL sales as shown above. A little bit of time spent on working out the most recent trends can give you an information edge which might just stop you getting your fingers burned.

Other things to look out for

If you want to become a better investor then you need to spend some time understanding the risks facing companies. A profit warning is just the way that these risks tend to be exposed.

Here are some of the main risks that expose some companies to a greater probability of a profit warning:

Highly indebted companies

Companies with lots of debt are known as highly geared. The interest on the debt has to be paid before shareholders can be paid. A fall in trading profits magnifies (gears) the fall in profits to shareholders as more of it is eaten up by interest payments.

This is why large amounts debt is only really suitable for companies with very stable revenues and profits such as utility companies.

A heavy reliance on commodity prices

The profits of mining and oil companies are very sensitive to changes in commodity and oil prices. Whilst they can make more money by producing more, by far the biggest impact on profits comes from the price of the commodity they are selling.

This is due to the fact that they have very large fixed costs - costs that are the same regardless of the level of output - which have a very similar effect on profits as the interest payments on debts. This is known as operational gearing or operational leverage.

You only need to look at the damage inflicted on oil company profits and share profits during the last eighteen months from a falling oil price.

House builders might fall into this category as well. Rising house prices give a big boost to their profits and falling prices inflict a lot of damage on them as was shown in the early 1990's and 2008-09.

Cyclical companies

The profits of industrial and manufacturing companies tend to move up and down with the fortunes of the economy in general - the economic cycle. They are known as cyclical companies for this reason.

So how do you spot potential trouble in a cyclical company?

It's not always easy but you can look at measures such as profit margins and ROCE over time. These tend to peak when times are good but cannot stay high when the economy falters and goes into a recession.

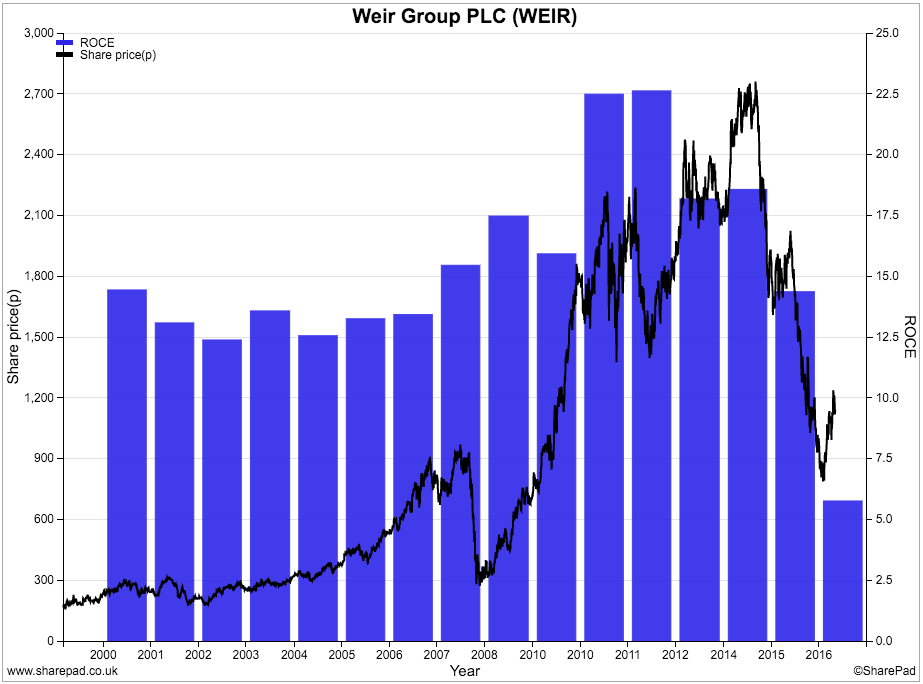

Take a look at the chart below. It shows the ROCE of engineering company Weir Group plotted against its share price back to the year 2000. ROCE peaked in 2012 and then started to fall in 2013 but was still above its previous peak of 2008. Hindsight is a wonderful thing but selling in 2013 as ROCE started to turn down from a peak would have been a good thing to have done.

Buying cyclical shares when ROCE and share prices are low can also be a good thing to do which might mean that Weir shares are worthy of a closer look.

Sometimes though ROCE is not a good indicator of peak profits to help the timing of buy and sell decisions. This is due to the fact that the ratio can become distorted by things such as acquisitions and the timing of investment in new assets.

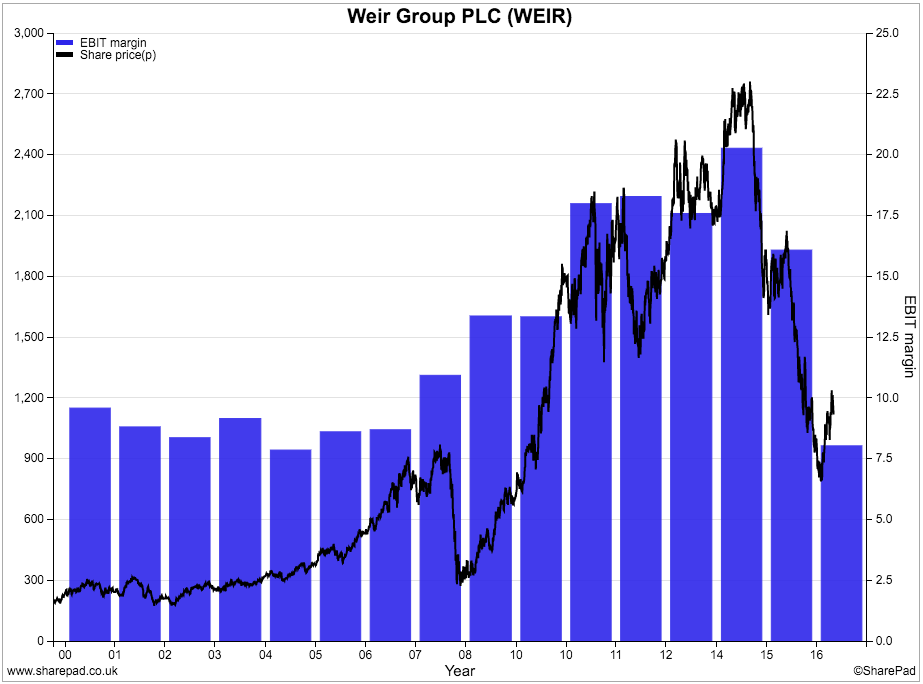

Profit margins can sometimes be a better indicator - providing that the nature of a company's business has been the same or similar over time.

In the case of Weir, a peak in profit margins happened to coincide with a peak in the share price in 2014. My guess is that very few analysts at the time were predicting that Weir's margins would fall from over 20% to around 8% in the space of two years.

Yet anyone who had taken the time to study a history of the company's profit margins would have been able to see that profit margins had moved up and down in the past and had been a lot lower. SharePad contains over twenty years of financial data for many companies which gives you the ability to do this kind of research in a matter of minutes.

A bit of further research as to why margins had changed might have seen the margin peak in 2014 as a selling opportunity. However, there is no shortage of people who will always say that "it's different this time around" and the past will not repeat itself.

Are profit warnings buying opportunities?

Potentially, yes.

There's an old saying that you shouldn't try and catch a falling knife. However, when you get a company that has issued a series of profit warnings, its shares can become so unpopular and so lowly valued that they become attractive to a corporate buyer.

The recent experience of Home Retail (LSE:HOME) is a good case in point.

The company issued a profits warning last autumn which saw its share price collapse. It was then the subject of a bidding war which ended up with Sainsbury's buying the company. Some savvy investors spotted an opportunity at the time and were richly rewarded for their efforts.

Some commentators have suggested that Restaurant Group's share price has fallen so far that it too might be gobbled up by a rival restaurant chain or private equity bidder. But what should you be looking out for in a potential takeover candidate?

- Is it a strategic asset? Can the business fit in nicely to someone else's and help it become better. In the case of Home Retail, Sainsbury's clearly thought that Argos would help it compete better with the likes of Amazon. Restaurant Group might have some attractive locations that rivals would like to get their hands on.

- Does it have strong finances? Companies with little or no debt can become targets for private equity companies which like to load companies up with debt, improve the profits for a few years and then sell the business. Argos had a debt free balance sheet but had a lot of hidden debt due to the fact that it rented its stores. High rent bills, high borrowings and large pension fund deficits can deter buyers.

- Can the business recover? Some businesses just become weaker. The profit warnings show investors how that process plays out. But some businesses have just hit a rough patch and there is often potential for it to recover. Some companies are inefficient and can be improved significantly leading to higher profits.

- Are the shares cheap enough? Share prices can fall to very low and distressed valuations. If they can offer a high return to a buyer on current or recovered profits then they might just make a tempting takeover target?

To sum up

- The risk of a profit warning is one of the biggest risks of owning a share.

- There are different types of profit warnings.

- Profit warnings are rarely a single event. A period of deteriorating trading can lead to a series of warnings.

- Some businesses are more susceptible to profit warnings than others.

- High valuations increase the risks from profit warnings.

- Slowing sales growth is one of the best ways to spot a potential profit warning.

- Understanding the history of profit margins and ROCE can help you to buy and sell the shares of cyclical companies.

- Profit warnings can create buying opportunities.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.